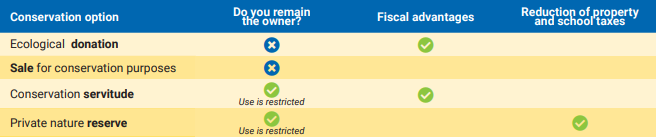

What are the different conservation options available?

Several legal options to preserve the natural areas on your property are available to you. Depending on the option selected, you could benefit from fiscal advantages or a reduction in school and property taxes. These options could apply to all or a part of your property. The choice of option will take into consideration the characteristics of your property, the usages you would like to maintain and your personal objectives.

Ecological donation

A property owner can donate all or a part of their property to a conservation organization, a municipality or the government. An ecological donation provides specific fiscal advantages under the Canadian Income Tax Act and the Québec Taxation Act, which vary depending on the financial situation of each owner and the value of the donation. Compared to most other charitable donations, ecological donations allow the capital gains inclusion rate to be reduced to zero and there is no limit on revenue for the calculation of the tax credit. If the property is donated via a will to a conservation organization, the owner will continue to benefit from it during their lifetime, with the fiscal advantages of the donation falling to the succession.

Conservation servitude

In the case where the owner wishes to keep their property, it is possible to establish a conservation servitude with a conservation organization, a municipality or the government to ensure the protection of the natural areas of their property, in whole or in part. Conservation servitudes create a legal agreement outlining the restrictions on the usages permitted, such as the construction of buildings or roads, to ensure the protection of the natural areas on the property. The types of restrictions will depend on the ecological characteristics of the property, the measures needed for its conservation and the owner’s objectives. A conservation servitude has the advantage of allowing the owner to maintain certain activities on the property, so long as they respect the conservation objectives. A conservation servitude can be for a limited period or in perpetuity and is associated with the title to the property. However, to obtain any fiscal advantages, the servitude must be in perpetuity.

Sale for the purpose of conservation

A property owner can choose to sell their property, in part or totality, to a conservation organization, a municipality or the government who will ensure its protection in perpetuity. The owner can also sell it for less than its market value.

Private nature reserve

In the case where the owner wishes to keep their property, it is also possible to designate some or all of the property as a private nature reserve. The owner enters into a legal agreement with the Gouvernement du Québec regarding the conservation measures. The agreement commits the owner to voluntarily refrain from certain usages in order to protect the natural areas within it. The recognition of a private nature reserve gives the owner a reduction in property taxes and an exemption from school taxes. As with the conservation servitude, the agreement is linked to the property and any future owners are required to respect the agreement. A private nature reserve can be for a minimum of 25 years, but mostly in perpetuity.

For more information:

The pamphlet Conservation: The Priority!

The pamphlet Conservation by Engaged Owners

The pamphlet Conservation: what are your options ?

.png)

.JPG)

.JPG)